Subject:

Investment Incentives for the Iron and Steel Sector

Reading Time:

10 Min

Date:

Dec 8, 2025

What is the Iron and Steel Industry?

The iron and steel industry is fundamentally a necessity for the activation of industrialization in areas such as defense, machinery, and automotive, which is essential for the development and growth of all societies. Over the years, iron has found its place in every aspect of our lives and continues to do so. According to 2022 data, it has been stated that over 40 million tons of production was achieved in the iron and steel industry, with a target of reaching 50 million tons within the next 10 years.

What are the Investment Incentives for the Iron and Steel Industry?

Investment incentives for Iron and Steel Investments are among investment topics subject to specific conditions. Investments related to the production of iron and steel products listed in Appendix 5 (However, only the enterprises that jointly meet the criteria below in these production topics) can be supported only through the general incentive system;

a) The total shares of one or more legal entities or public institutions and organizations in the partnership structure shall not exceed 25% or more.

b) Not holding 25% or more of the capital of another enterprise.

c) Number of employees must be less than 250 per year.

ç) Annual net sales revenue must not exceed 50 million Euros or the value of the financial balance sheet exceeding 43 million Euros equivalent in Turkish Lira.

IRON AND STEEL PRODUCTS

Product | Customs Tariff Statistical Position (G.T.P.) | ||||

Pig iron | 7201 | ||||

Iron alloys | 7202 11 20 | 7202 11 80 | 7202 99 11 | ||

Alloy products and other sponge-like iron products obtained by direct reduction of iron ore | 7203 | ||||

Iron and non-alloy steel | 7206 | ||||

Semifinished iron or non-alloy steel products | 7207 11 11 | 7207 11 14 | 7207 11 16 | 7207 12 10 | 7207 19 11 |

7207 19 14 | 7207 19 16 | 7207 19 31 | 7207 20 11 | 7207 20 15 | |

7207 20 17 | 7207 20 32 | 7207 20 51 | 7207 20 55 | 7207 20 57 | |

7207 20 71 | |||||

Flat rolled products of iron and non-alloy steel | 7208 10 00 | 7208 25 00 | 7208 26 00 | 7208 27 00 | 7208 36 00 |

7208 37 | 7208 38 | 7208 39 | 7208 40 | 7208 51 | |

7208 52 | 7208 53 | 7208 54 | 7208 90 10 | 7209 15 00 | |

7209 16 | 7209 17 | 7209 18 | 7209 25 00 | 7209 26 | |

7209 27 | 7209 28 | 7209 90 10 | 7210 11 10 | 7210 12 11 | |

7210 12 19 | 7210 20 10 | 7210 30 10 | 7210 41 10 | 7210 49 10 | |

7210 50 10 | 7210 61 10 | 7210 69 10 | 7210 70 31 | 7210 70 39 | |

7210 90 31 | 7210 90 33 | 7210 90 38 | 7211 13 00 | 7211 14 | |

7211 19 | 7211 23 10 | 7211 23 51 | 7211 29 20 | 7211 90 11 | |

7212 10 10 | 7212 10 91 | 7212 20 11 | 7212 30 11 | 7212 40 10 | |

7212 40 91 | 7212 50 31 | 7212 50 51 | 7212 60 11 | 7212 60 91 | |

Bars and wire rods from iron or non-alloy steel, hot-rolled, irregularly coiled | 7213 10 00 | 7213 20 00 | 7213 91 | 7213 99 | |

Other rods and wire rods of iron and non-alloy steel | 7214 20 00 | 7214 30 00 | 7214 91 | 7214 99 | 7215 90 10 |

Profiles of iron or non-alloy steel | 7216 10 00 | 7216 21 00 | 7216 22 00 | 7216 31 | 7216 32 |

7216 33 | 7216 40 | 7216 50 | 7216 99 10 | ||

Stainless steel | 7218 10 00 | 7218 91 11 | 7218 91 19 | 7218 99 11 | 7218 99 20 |

Flat rolled products of stainless steel | 7219 11 00 | 7219 12 | 7219 13 | 7219 14 | 7219 21 |

7219 22 | 7219 23 00 | 7219 24 00 | 7219 31 00 | 7219 32 | |

7219 33 | 7219 34 | 7219 35 | 7219 90 10 | 7220 11 00 | |

7220 12 00 | 7220 20 10 | 7220 90 11 | 7220 90 31 | ||

Product | Customs Tariff Statistical Position (G.T.P.) | ||||

Stainless steel bars and wire rods | 7221 00 | 7222 11 | 7222 19 | 7222 30 10 | 7222 40 10 |

7222 40 30 | |||||

Other flat rolled products from alloyed steel | 7225 11 00 | 7225 19 | 7225 20 20 | 7225 30 00 | 7225 40 |

7225 50 00 | 7225 91 10 | 7225 92 10 | 7225 99 10 | 7226 11 10 | |

7226 19 10 | 7226 19 30 | 7226 20 20 | 7226 91 | 7226 92 10 | |

7226 93 20 | 7226 94 20 | 7226 99 20 | |||

Other alloyed steel rods and wire rods | 7224 10 00 | 7224 90 01 | 7224 90 05 | 7224 90 08 | 7224 90 15 |

7224 90 31 | 7224 90 39 | 7227 10 00 | 7227 20 00 | 7227 90 | |

7228 10 10 | 7228 10 30 | 7228 20 11 | 7228 20 19 | 7228 20 30 | |

7228 30 20 | 7228 30 41 | 7228 30 49 | 7228 30 61 | 7228 30 69 | |

7228 30 70 | 7228 30 89 | 7228 60 10 | 7228 70 10 | 7228 70 31 | |

7228 80 | |||||

Rails and sleepers | 7302 10 31 | 7302 10 39 | 7302 10 90 | 7302 20 00 | 7302 40 10 |

7302 10 20 | |||||

Seamless tubes, pipes, and hollow profiles | 7303 | 7304 | |||

Welded iron or steel tubes and pipes with an outer diameter exceeding 406.4 mm | 7305 | ||||

What are the Support Elements within the Scope of the General Investment Incentive Certificate for the Iron and Steel Industry?

Investments that meet the condition of a minimum investment amount determined without any distinction of region and do not fall within investment topics that will not be incentivized and other incentive applications.

Support Elements | General Incentive Applications |

VAT Exemption | √ |

Customs Duty Exemption | √ |

Tax Reduction | |

Employer Share Support for Insurance Premium | |

Income Tax Withholding Support | √ |

Employee Share Support for Insurance Premium | |

Interest or Profit Share Support | |

Investment Site Allocation | |

VAT Refund |

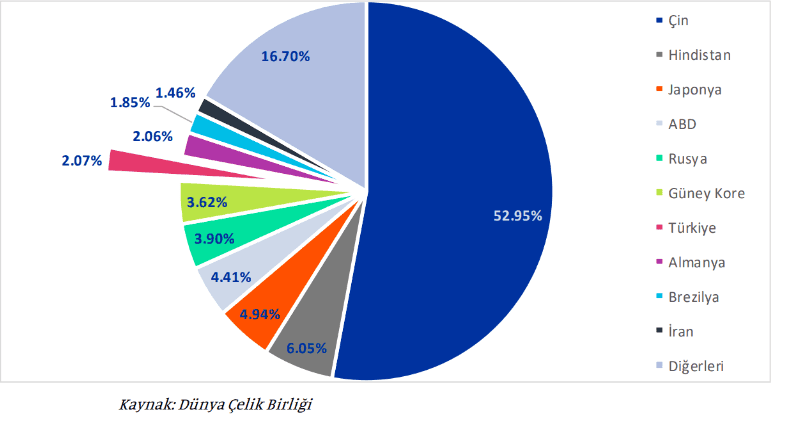

The Situation of the Iron and Steel Industry in Turkey and the World

Based on monthly data from 2022, the export amount and rate of the iron and steel industry have increased. The ratio of exports meeting imports has risen above 80% compared to the previous year. The decrease in production in the first months of 2022 in the iron and steel industry is thought to be caused by the Russia-Ukraine war, the global energy crisis, and the disruptions in the supply chain. However, considering developments both globally and in our country, it is an inevitable fact that production in the iron and steel industry will continue to increase.

Leading Companies in the Iron and Steel Industry

Some of the prominent iron and steel companies in Turkey include Ereğli Demir Çelik (EREGL), İskenderun Demir Çelik (ISDMR), Kardemir Karabük Demir Çelik (KRDMD), and İzmir Demir Çelik (IZMDC). The distribution of leading iron and steel companies around the world;